Grow Your Business Smarter with QuickBooks

Why QuickBooks Is the Top Choice for Accounting in 2025

introduction

In 2025, businesses of all sizes face increasing financial complexity, from managing expenses and payroll to staying compliant with evolving tax regulations. In this challenging landscape, QuickBooks continues to stand out as the top choice for accounting software, offering an all-in-one solution that simplifies financial management while providing powerful tools for growth.

QuickBooks is trusted by millions of businesses worldwide due to its combination of versatility, accuracy, and ease of use. Its cloud-based platform allows business owners and accounting professionals to access their financial data anytime, anywhere, whether on a laptop, tablet, or smartphone. This flexibility ensures that companies can make timely financial decisions, collaborate effectively with teams, and maintain complete control over their finances.

One of the key reasons QuickBooks remains the leading accounting software in 2025 is its integration of advanced AI tools. These intelligent features assist with bookkeeping, automate repetitive tasks, and provide insights into financial trends, saving time and reducing errors. Whether it’s tracking expenses, managing invoices, or analyzing cash flow, QuickBooks helps users stay organized and make informed decisions with confidence.

Beyond its functionality, QuickBooks offers scalable solutions that adapt to businesses of all sizes. From freelancers and startups to mid-sized companies and large enterprises, the software provides flexible plans, customizable features, and seamless integration with other business tools. Combined with robust security measures, regular updates, and dedicated customer support, QuickBooks ensures that businesses not only manage their finances efficiently but also gain a competitive edge in a fast-paced market.

For any business aiming for accurate, efficient, and insightful accounting in 2025, QuickBooks remains the clear and reliable choice.

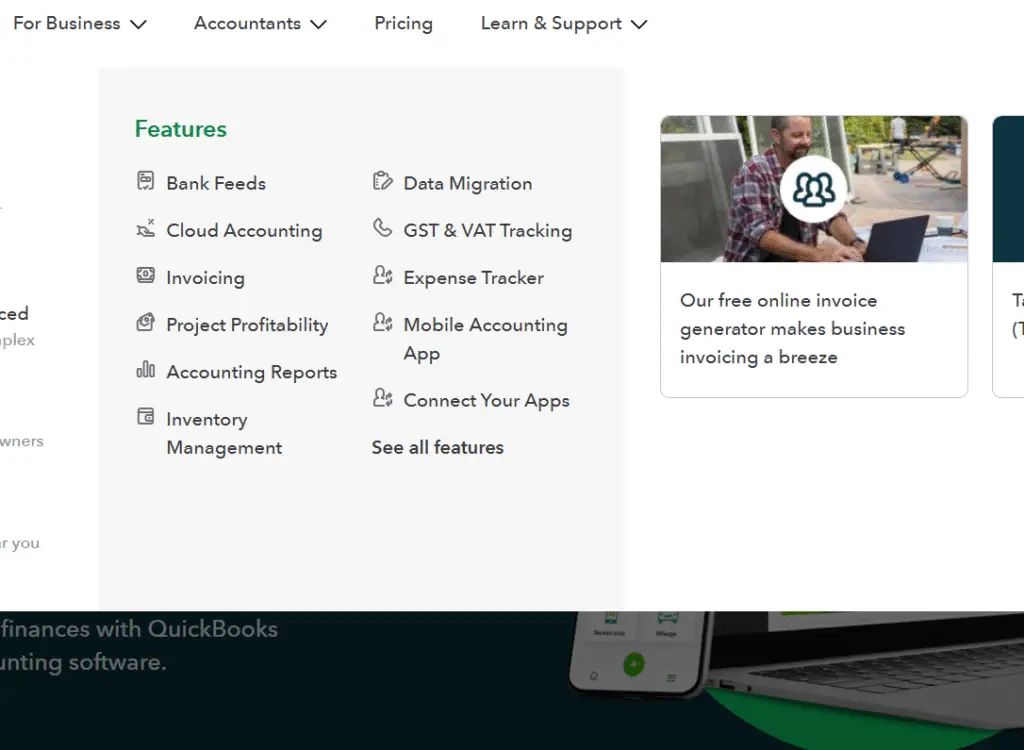

Discover the Key Features That Make QuickBooks Stand Out

QuickBooks has established itself as one of the most popular accounting software solutions, and its wide range of features is a major reason why. Whether you are a small business owner, freelancer, or part of a growing enterprise, QuickBooks provides tools that simplify accounting, enhance productivity, and help you make informed financial decisions.

One of the standout features of QuickBooks is its cloud-based accessibility. Users can access their financial data anytime and anywhere, using a computer, tablet, or smartphone. This flexibility ensures real-time updates, smooth collaboration with team members, and immediate insights into business performance.

Invoicing and payments is another key feature. QuickBooks allows you to create professional invoices, send them directly to clients, and accept online payments. This feature helps businesses get paid faster and reduces manual tracking.

QuickBooks also excels in expense tracking and payroll management. You can automatically categorize expenses, monitor cash flow, and process payroll accurately while staying compliant with tax regulations. This automation saves time and reduces the risk of errors.

Another significant advantage is customizable reporting and analytics. QuickBooks provides detailed financial reports, helping business owners understand trends, evaluate performance, and make strategic decisions.

Integration with third-party apps is another feature that makes QuickBooks stand out. From CRM systems to e-commerce platforms, these integrations enhance workflow efficiency and allow businesses to manage multiple operations from a single dashboard.

Finally, QuickBooks offers robust security with data encryption and two-factor authentication, ensuring that sensitive financial information remains safe.

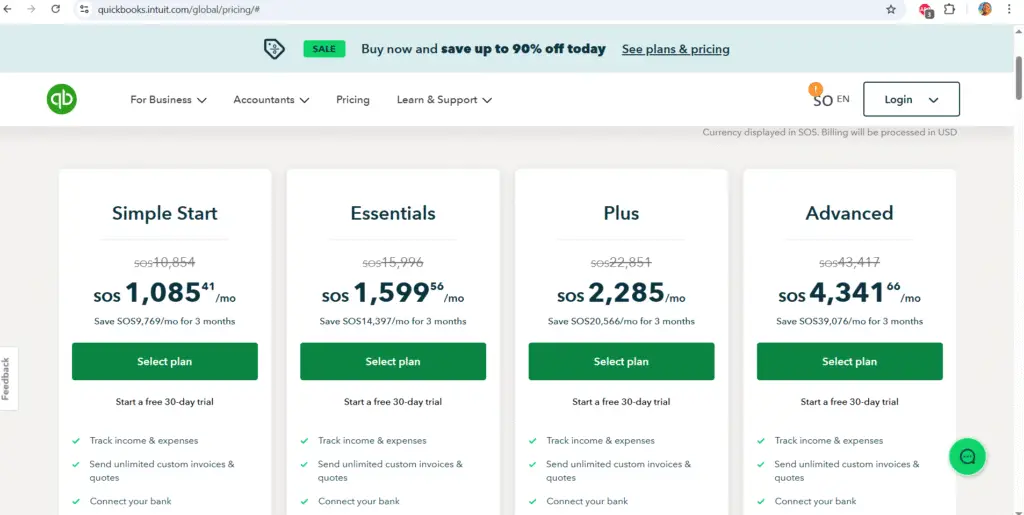

QuickBooks Pricing Plans – Which One Is Right for You?

QuickBooks offers a variety of pricing plans designed to meet the needs of businesses of all sizes. Understanding these plans can help you choose the right solution for your financial management needs, whether you’re a freelancer, small business owner, or growing enterprise.

The Simple Start plan is ideal for freelancers or small businesses that need basic accounting tools. It includes features like income and expense tracking, invoicing, tax preparation, and access to bank account integration. This plan is perfect for users who want a straightforward solution to manage everyday financial tasks.

For growing businesses, the Plus plan offers more advanced features. In addition to everything in Simple Start, it includes project tracking, inventory management, and the ability to track profitability by location or customer. This plan is suitable for businesses with multiple revenue streams or teams that require detailed reporting and oversight.

The Advanced plan is designed for larger businesses or those with complex accounting needs. It provides premium features like dedicated account support, customizable reporting, batch invoicing, and enhanced automation. Businesses that require scalability, multiple users, and advanced insights will benefit most from this plan.

QuickBooks also offers a Self-Employed plan for freelancers and independent contractors. It focuses on tracking mileage, quarterly taxes, and simplified expense categorization to help self-employed users stay organized

The Honest Pros and Cons of Using QuickBooks

QuickBooks is one of the most widely used accounting software solutions, trusted by millions of businesses around the world. Its popularity stems from a combination of user-friendly design, comprehensive features, and automation capabilities that simplify financial management. Small business owners, freelancers, and accounting professionals alike benefit from QuickBooks’ intuitive interface, which makes tasks like invoicing, expense tracking, payroll management, and tax preparation easier and faster.

One of QuickBooks’ biggest advantages is its ability to automate repetitive tasks, reducing human error and saving time. Its cloud-based platform allows users to access real-time financial data from anywhere, making remote collaboration seamless. Additionally, QuickBooks integrates with numerous third-party applications, including e-commerce and CRM tools, further enhancing workflow efficiency.

However, like any software, QuickBooks has some limitations, such as higher costs for advanced plans and a learning curve for complex features. Understanding these pros and cons can help you determine if QuickBooks is the right fit for your business.

Pros of Using QuickBooks

QuickBooks offers a user-friendly interface, making accounting accessible even for those without formal finance training. Its cloud-based access allows you to view financial data anytime, anywhere, using a computer or mobile device, which is ideal for remote work or managing multiple locations. The software also provides comprehensive features, including invoicing, expense tracking, payroll, inventory management, and detailed financial reporting.

Another major benefit is automation and AI integration. QuickBooks automates recurring invoices, payroll, tax calculations, and other repetitive tasks, reducing errors and saving time. Additionally, its ability to integrate with third-party applications, such as CRM systems, e-commerce platforms, and payment gateways, enhances workflow efficiency and helps businesses centralize operations.

Cons of Using QuickBooks

One common drawback is cost, as some users find advanced plans relatively expensive. There is also a learning curve for advanced features; mastering complex reporting or inventory management may take time. Some users report occasional performance issues, such as slower loading during peak hours or dependence on internet speed. Lastly, limited customization on lower-tier plans may not meet all the needs of growing businesses.

How QuickBooks Helps Small Businesses Grow and Succeed

Small businesses face numerous challenges, from managing cash flow to staying compliant with taxes. QuickBooks has become an essential tool for many entrepreneurs because it simplifies accounting and provides the insights needed to make informed decisions, ultimately helping small businesses grow and succeed.

Streamlined Accounting and Bookkeeping

QuickBooks automates everyday accounting tasks, such as recording income and expenses, reconciling bank accounts, and generating financial reports. This reduces the risk of errors, saves time, and allows business owners to focus on growing their operations rather than getting bogged down in paperwork.

Cash Flow Management

Maintaining healthy cash flow is critical for small business success. QuickBooks provides real-time visibility into your income, expenses, and outstanding invoices. Automated reminders and integrated payment options help businesses get paid faster and manage their finances more effectively.

Simplified Tax Compliance

QuickBooks tracks expenses, calculates taxes, and generates reports that simplify tax filing. For small businesses, this reduces stress and ensures compliance with local tax regulations.

Actionable Insights and Reporting

QuickBooks offers customizable reports and dashboards that provide insights into sales trends, profitability, and expenses. This data allows business owners to make strategic decisions that support growth and long-term success.

Scalability and Integration

As a small business grows, QuickBooks scales with it. The platform integrates with a wide range of third-party apps, including CRM systems, e-commerce platforms, and payment gateways, helping businesses streamline operations and expand efficiently.

QuickBooks Compared to Other Accounting Tools – What Sets It Apart

When it comes to accounting software, small and medium-sized businesses have numerous options. QuickBooks, however, continues to stand out as a preferred choice due to its comprehensive features, ease of use, and scalability. Understanding what sets QuickBooks apart from other accounting tools can help businesses make an informed decision.

User-Friendly Interface

Unlike some accounting tools that require advanced accounting knowledge, QuickBooks offers an intuitive, easy-to-navigate interface. Users can manage invoices, track expenses, and generate reports with minimal training, making it ideal for business owners and small teams.

Comprehensive Feature Set

QuickBooks provides a wide array of functionalities, including invoicing, expense tracking, payroll management, inventory control, and detailed financial reporting. While other accounting tools may offer some of these features, QuickBooks delivers them in one integrated platform, reducing the need for multiple software subscriptions.

Cloud-Based Access

QuickBooks Online allows users to access financial data anytime, anywhere. Many alternative tools still rely on desktop-based applications, limiting remote accessibility and collaboration. QuickBooks’ cloud capabilities make it easier for teams to work together and for business owners to monitor finances in real time.

Automation and AI Integration

QuickBooks incorporates automation for recurring invoices, payroll, and tax calculations. Advanced AI tools also help with bookkeeping, forecasting, and financial insights. While competitors may offer automation, QuickBooks’ AI-driven solutions are particularly robust, saving time and minimizing errors.

Third-Party Integrations

QuickBooks integrates seamlessly with hundreds of third-party apps, including e-commerce, CRM, and payment platforms. This flexibility allows businesses to customize their workflow, something many other accounting tools struggle to provide.

Step-by-Step Guide to Getting Started with QuickBooks

Step-by-Step Guide to Getting Started with QuickBooks

QuickBooks is a powerful accounting tool that simplifies financial management for businesses of all sizes. Getting started with QuickBooks is straightforward, even for beginners. This step-by-step guide will help you set up your account and begin managing your finances efficiently.

Step 1: Choose the Right QuickBooks Plan

QuickBooks offers several plans, including Simple Start, Plus, Advanced, and Self-Employed. Evaluate your business needs, number of users, and required features to select the plan that best suits your goals.

Step 2: Sign Up and Set Up Your Account

Visit the QuickBooks website and sign up for your chosen plan. During setup, provide your business information, such as legal name, industry, and contact details. QuickBooks will tailor your dashboard based on this information.

Step 3: Connect Your Bank Accounts and Credit Cards

Link your business bank accounts and credit cards to QuickBooks for real-time tracking of income and expenses. This step automates transaction imports, reduces manual entry, and ensures accurate financial records.

Step 4: Customize Your Invoices and Payment Options

Set up your invoice templates, add your logo, and configure payment options. QuickBooks allows clients to pay directly online, helping you get paid faster and improving cash flow.

Step 5: Set Up Your Chart of Accounts

Organize your finances by setting up a chart of accounts that categorizes assets, liabilities, income, and expenses. QuickBooks provides a default chart, which you can customize according to your business needs.

Step 6: Explore Reports and Automation

Familiarize yourself with QuickBooks’ reporting tools and automation features. You can generate profit and loss statements, balance sheets, and expense reports. Automate recurring invoices and payroll to save time and reduce errors.

Exclusive QuickBooks Free Trial and Offers You Should Know

For businesses looking to streamline accounting without immediate financial commitment, QuickBooks provides an excellent opportunity through its free trial and exclusive offers. These options allow you to explore the platform, test its features, and determine if it’s the right fit for your business.

QuickBooks Free Trial

QuickBooks offers a 30-day free trial for new users, giving full access to its cloud-based accounting tools. During the trial, you can:

- Track income and expenses in real-time.

- Create and send professional invoices.

- Manage payroll and taxes.

- Generate detailed financial reports.

This trial allows businesses to experience QuickBooks’ ease of use, automation capabilities, and comprehensive reporting without any upfront cost, making it ideal for startups and small businesses.

Exclusive Offers

In addition to the free trial, QuickBooks often provides exclusive discounts and promotional plans. These offers may include a percentage off the first few months, free access to premium features for a limited time, or bundled services with payroll or payments. These promotions help new users maximize value while exploring the platform’s full potential.

Benefits of Trying Before Buying

Taking advantage of the free trial and offers allows you to evaluate:

- User interface and ease of navigation.

- Integration with your bank accounts and third-party apps.

- Automation tools for invoices, payroll, and reporting

Real Customer Reviews – Why People Love QuickBooks

QuickBooks has become a trusted accounting solution for millions of businesses worldwide. Its popularity is not just due to its features but also because of the positive experiences shared by real users. Reading customer reviews can help you understand why QuickBooks continues to be a top choice for business accounting.

Ease of Use

Many customers praise QuickBooks for its intuitive interface. Users report that even those without prior accounting experience can navigate the dashboard, create invoices, track expenses, and generate reports with ease. This user-friendly design allows business owners to save time and focus on growing their business.

Comprehensive Features

Reviews highlight QuickBooks’ all-in-one functionality. Customers appreciate features such as automated invoicing, expense tracking, payroll management, tax calculations, and customizable financial reports. Users consistently mention that having multiple essential tools in a single platform simplifies operations and reduces the need for multiple software subscriptions.

Cloud-Based Flexibility

QuickBooks Online receives positive feedback for its cloud-based accessibility. Users enjoy managing their finances from anywhere, whether on a desktop, tablet, or mobile device. This flexibility enables real-time updates, remote collaboration, and instant insights into business performance.

Support and Integration

Many customers emphasize the value of QuickBooks’ customer support and extensive integration options. From responsive help centers to connections with hundreds of third-party apps, users can quickly resolve issues and streamline workflows.

Overall Satisfaction

Across various platforms, QuickBooks consistently receives high ratings from small business owners, freelancers, and accountants alike. Users often report that the software saves time, reduces errors, and provides clear insights into their financial health, making it an indispensable tool for business success.

QuickBooks FAQs – Answers to All Your Important Questions

QuickBooks is one of the most popular accounting software solutions for businesses of all sizes. To help new and existing users make the most of the platform, we’ve compiled answers to the most frequently asked questions about QuickBooks.

1. What is QuickBooks?

QuickBooks is cloud-based accounting software that helps businesses manage their finances. It offers tools for invoicing, expense tracking, payroll management, tax filing, and financial reporting, making accounting simpler and more efficient.

2. Who Can Use QuickBooks?

QuickBooks is designed for freelancers, small business owners, and medium-sized enterprises. Its user-friendly interface and scalable plans make it suitable for businesses at any stage of growth.

3. What Are the QuickBooks Plans?

QuickBooks offers several plans: Simple Start, Plus, Advanced, and Self-Employed. Each plan varies in features, such as payroll, inventory management, reporting tools, and the number of users it supports.

4. Can I Try QuickBooks for Free?

Yes, QuickBooks provides a 30-day free trial. During this period, you can explore all features, link bank accounts, create invoices, and generate reports before committing to a paid plan.

5. Is QuickBooks Secure?

QuickBooks uses robust security measures, including data encryption and two-factor authentication, ensuring your financial information remains safe and private.

6. Can QuickBooks Integrate with Other Apps?

Yes, QuickBooks integrates with hundreds of third-party applications, including CRM, e-commerce, and payment platforms, to streamline workflows and improve business efficiency.